ECON1085 International Monetary Economics

Exam Practise questions

Topic 5: Internal and external balance

Question 1

(i) An economy is in internal balance but have a Current Account

deficit. Its IB schedule is steeper than the EB schedule. Explain in what

situation you would be able to restore external balance without disrupting

internal balance.

(ii) An economy is in external balance but have an unemployment

situation. Its IB schedule is steeper than the EB schedule. Explain in what

situation you would be able to restore internal balance without disrupting

external balance.

(iii) Explain why the external balance is upward sloping.

Question 2

(i) An economy is in internal balance but have a Current Account deficit. Its IB

schedule is steeper than the EB schedule. Explain in what situation you would

be able to restore external balance without disrupting internal balance.

(ii) An economy is in external balance but have an unemployment situation. Its IB

schedule is steeper than the EB schedule. Explain in what situation you would

be able to restore internal balance without disrupting external balance.

(iii) According to the Swan model, the order in which policy goals are pursued will

determine whether policy assignment is stabilising or destabilising. Do you

agree?

Question 3

(a) Assume that Singapore is currently achieving internal balance, but

experiencing a trade surplus. Also assume that Singapore faces a relatively

elastic IB schedule and a relative inelastic EB schedule. Explain how and

why an attempt to restore external balance will disrupt internal balance and

how internal balance would be restored.

(b) Assume that Malaysia is currently achieving internal balance, but

experiencing a trade deficit. Also assume that Malaysia faces a relatively

inelastic IB schedule and a relatively elastic EB schedule. Explain how and

why an attempt to restore external balance will disrupt internal balance and

how internal balance would be restored.

Topic 6: IS-LM-BP

Question 1

Using the ISLMBP model, explain the following situation:

(a) Explain the effects that a decrease in taxes has for the domestic economy with

zero capital mobility under a fixed and a flexible exchange rate system.

(b) Explain the effects that an increase in money supply has for the domestic

economy with perfect capital mobility under a fixed and a flexible exchange

rate system.

Question 2

Using the ISLMBP model, explain the following situation:

(i) Assume zero capital mobility; explain the effects that an increase in

government expenditure has for the domestic economy under a fixed and a

flexible exchange rate system.

(ii) Assume perfect capital mobility; explain the effects that an increase in money

supply has for the domestic economy under a fixed and a flexible exchange rate

system.

Question 3

(i) Assume that Singapore is currently achieving internal balance, but experiencing

a trade surplus. Also assume that Singapore faces a relatively elastic IB schedule

and a relative inelastic EB schedule. Explain how and why an attempt to restore

external balance will disrupt internal balance and how internal balance would be

restored.

(ii) Assume that Malaysia is currently achieving internal balance, but experiencing a

trade deficit. Also assume that Malaysia faces a relatively inelastic IB schedule

and a relatively elastic EB schedule. Explain how and why an attempt to restore

external balance will disrupt internal balance and how internal balance would be

restored.

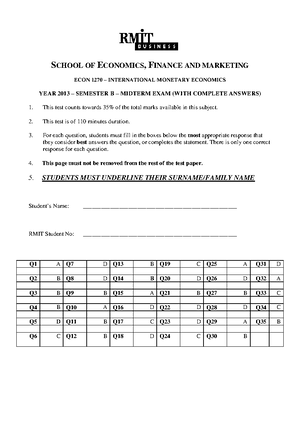

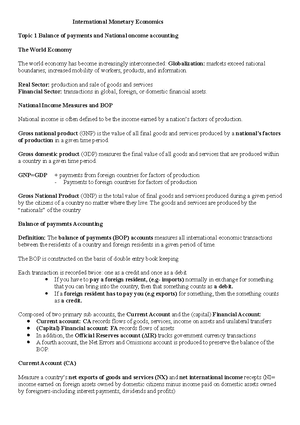

Exam 2013, Questions And Answers – Final Exam

International Monetary Economics100% (13)

-

7

Exam 2013, Questions And Answers – Midterm

International Monetary Economics100% (9) -

11

Online Quiz Midterm test bank

International Monetary Economics100% (4) -

2

Learning Resources Notes

International Monetary Economics100% (2) -

5

IME NOTE – lecture note

International Monetary Economics100% (2) -

27

Exam 2010, questions and answers – topics 1-7

International Monetary Economics73% (11)

support@essaywritingexpert.org

support@essaywritingexpert.org